Searching for affordable auto insurance? Head over to NewAutoInsurance to compare quotes and save on your policy! Have questions? Call us at 833-211-3817 for immediate assistance!

Let’s face it—no one enjoys shopping for car insurance. But if you live in West Virginia, you know how expensive it can get. The good news? You might be paying way more than you need to!

Take John, for example. He lives in Charleston, WV, and was shelling out nearly $150 a month for auto insurance. Frustrated, he decided to compare rates. After switching companies and applying a few smart discounts, his premium dropped to just $78 per month! If John can do it, so can you.

In this guide, we’ll walk you through the best ways to save on cheap auto insurance in WV, covering everything from top insurance providers to insider money-saving tips.

Why Is Auto Insurance Expensive in WV?

If your car insurance feels high, you’re not imagining it. Here’s why WV drivers often pay more:

- Winding Roads & High Accident Rates – West Virginia’s mountain roads can be tricky, leading to more accidents.

- Severe Weather Conditions – Harsh winters, flooding, and storm damage increase insurance claims.

- Uninsured Drivers – A surprising number of WV drivers don’t carry insurance, increasing risk for everyone else.

Understanding these factors can help you make smarter choices when shopping for the best rates.

How to Get the Cheapest Auto Insurance in WV

1. Compare Insurance Companies Before You Buy

No two insurance companies charge the same price. That’s why shopping around is key. Here are some of the most affordable auto insurance providers in WV:

- Geico – Best for budget-conscious drivers

- State Farm – Great customer service and local agents

- Progressive – Ideal for high-risk drivers

- Erie Insurance – Personalized coverage at competitive rates

- USAA – Excellent option for military families

2. Maximize Discounts

Insurance companies offer plenty of discounts, but many drivers don’t take full advantage. Here are some you might qualify for:

✅ Safe Driver Discount – Up to 20% off for accident-free driving

✅ Multi-Car Discount – Save when insuring multiple vehicles

✅ Bundling Discount – Combine home and auto insurance for extra savings

✅ Low-Mileage Discount – If you drive less than 7,500 miles a year, you could save

✅ Student Discount – Good grades can cut young drivers’ premiums by 15%

3. Raise Your Deductible

If you can afford a higher deductible (e.g., $1,000 instead of $500), your monthly premium will be lower. Just make sure you have the savings to cover it in case of an accident.

4. Keep Your Credit Score High

It might sound surprising, but insurance companies consider your credit score when setting rates. A higher score can mean lower premiums, so it’s worth improving.

Searching for affordable auto insurance? Head over to NewAutoInsurance to compare quotes and save on your policy! Have questions? Call us at 833-211-3817 for immediate assistance!

5. Consider Telematics (Usage-Based Insurance)

Many insurers offer safe driving programs that track your driving habits through an app or plug-in device. If you drive responsibly, you could earn significant discounts.

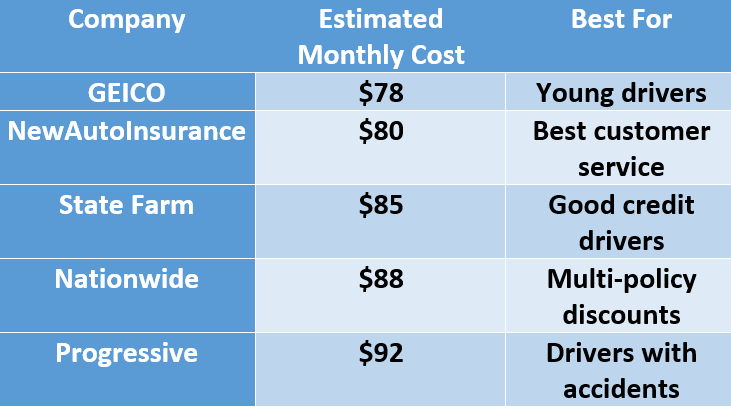

Best Cheap Auto Insurance Companies in WV (2025)

We compared insurers based on affordability, coverage options, and customer satisfaction. Here’s what we found:

(Note: Rates vary based on location, driving history, and coverage options.)

How John Slashed His Insurance Bill by 48%

Let’s go back to John’s story. Here’s how he cut his bill from $150 to $78 per month:

1️⃣ Got Quotes from 5 Companies – Geico offered him the lowest rate

2️⃣ Increased His Deductible – Switched from $500 to $1,000, lowering his monthly payments

3️⃣ Signed Up for a Safe Driving Program – Earned an extra 15% discount

4️⃣ Bundled Auto & Renter’s Insurance – Saved another 10%

🚗 End result? John now saves $864 a year—just by making a few simple changes!

Should You Work with a Local WV Insurance Agent?

While online quotes are easy, working with a local insurance agent can sometimes save you even more. They understand West Virginia’s unique laws and can help you uncover hidden discounts.

Tips for New and Young Drivers in WV

Getting affordable auto insurance can be especially challenging for new and young drivers. Here are some targeted tips:

-

Take a Defensive Driving Course:

Many insurers offer discounts for completing accredited defensive driving courses. -

Maintain Good Grades:

For student drivers, high academic performance can lead to significant discounts. -

Choose a Car That’s Cheap to Insure:

Some vehicles have lower repair costs and higher safety ratings, making them less expensive to insure. -

Build a Clean Driving Record:

Focus on safe driving habits from the start. A clean record helps lower premiums over time.

These steps can help new drivers secure better rates and establish good habits for long-term savings.

What Affects Your Car Insurance Rates in West Virginia?

Your premium isn’t just based on your driving record. Other factors include:

- Age & Gender – Younger and male drivers often pay more.

- Type of Car – A sports car will cost more to insure than a sedan.

- Location – Urban areas typically have higher rates due to more traffic and crime.

- Driving History – Accidents and tickets can increase your premiums significantly.

- Credit Score – As mentioned earlier, a higher score can help you get a better rate.

Common Mistakes That Increase Your Insurance Cost

Avoid these mistakes to keep your premiums low:

🚨 Not Shopping Around – Sticking with the same insurer for years might mean overpaying.

🚨 Ignoring Discounts – Always check if you qualify for new discounts.

🚨 Buying More Coverage Than Needed – If you drive an older car, you might not need full coverage.

🚨 Skipping Policy Reviews – Your situation changes, and so should your coverage.

Expert-Backed Tips to Lower Your Auto Insurance Costs

✅ Review Your Policy Annually – Your rates may change, and you might qualify for new discounts

✅ Drive a Safe, Reliable Car – Insurance is cheaper for vehicles with high safety ratings

✅ Drop Unnecessary Coverage – If your car is old, dropping comprehensive/collision coverage can make sense

✅ Check for Employer or Membership Discounts – Some jobs and organizations offer insurance savings

✅ Avoid Lapses in Coverage – A gap in coverage can make your rates go up when you buy a new policy

FAQs: Your Questions Answered About Cheap Auto Insurance in WV

Q: What is the average cost of auto insurance in WV?

A: While the average cost varies, many drivers find that rates range between $70 and $90 per month when they shop around and take advantage of discounts.

Q: How can I lower my auto insurance premium quickly?

A: Start by comparing multiple quotes, increasing your deductible, and ensuring you’re receiving all available discounts. Enrolling in a safe driving program can also help reduce your rate over time.

Q: Are online quotes reliable?

A: Yes, online quotes are a great starting point for getting a sense of your options. However, speaking with a local agent may uncover additional savings not immediately visible online.

Q: Does my credit score really affect my premium?

A: Absolutely. Insurers use your credit score as an indicator of risk, so a higher credit score generally translates to lower premiums.

Q: Should I bundle my insurance policies?

A: Bundling auto with home or renter’s insurance can often lead to significant savings on both policies, making it a smart move for many drivers.

Final Thoughts – How Much Can You Save?

If you’re paying over $78/month for car insurance, you could be overpaying. A few simple steps—like comparing quotes and applying discounts—can put money back in your pocket.

Why wait? Take 5 minutes today to compare rates and start saving on cheap auto insurance in WV.

Take the next step toward affordable coverage. Visit NewAutoInsurance and get instant quotes that fit your budget and driving needs. If you’d like to speak with a representative, call us at 833-211-3817!

Explore InsuranceShopping to find a wide range of insurance options tailored to your needs.

For more tips, check our guide on Find Top Automobile Insurance Brokers Near Me