Navigating car insurance can be daunting, but understanding $20 Down Payment Car Insurance can simplify things. This policy allows you to start coverage with just a $20 upfront payment, making it an attractive option for those on a tight budget or needing immediate coverage without a large initial expense.

Key Benefits:

- Affordability: Initiate your policy with only $20, making it budget-friendly.

- Immediate Coverage: Get insured quickly without waiting for a significant sum.

- Flexibility: Often includes flexible payment plans to fit your financial situation.

Consider a college student who just purchased a used car. They need insurance to drive legally but have limited funds. A $20 down payment car insurance policy allows them to drive without financial strain, offering peace of mind and legal compliance. However, it’s crucial to note that while the initial payment is low, the overall insurance cost might be higher over time. It’s wise to compare different policies and read the fine print to ensure you get the best deal for your needs. By understanding $20 down payment car insurance, you can make informed decisions that align with your financial goals and driving requirements.

How to Qualify for $20 Down Payment Car Insurance

Understanding how to qualify for $20 down payment car insurance can simplify the often complex process of securing affordable coverage. This option is particularly appealing for those seeking to minimize upfront costs. However, eligibility is not universal and depends on several factors. Insurers typically offer $20 down payment options to attract new customers or provide flexibility for budget-conscious individuals. To qualify, you might need to meet specific criteria.

Key factors influencing eligibility include:

- Driving History: Maintaining a clean driving record without recent accidents or violations can significantly boost your chances.

- Credit Score: A strong credit score often results in better insurance rates and more favorable down payment terms.

- Vehicle Type: Insurers may offer lower down payments for vehicles that are cheaper to insure.

Real-world examples highlight the importance of shopping around and comparing quotes. Take Sarah, a young driver from Texas, who secured a policy within her budget by leveraging her excellent credit score and spotless driving history. Her experience underscores the value of thorough research and negotiation with insurers. Ultimately, qualifying for $20 down payment car insurance involves some effort, but the potential savings make it worthwhile. By understanding eligibility factors and proactively improving your standing, you can enjoy affordable car insurance without financial strain.

Top Benefits of Choosing $20 Down Payment Car Insurance

Finding the right car insurance can be challenging, especially when balancing coverage needs with budget constraints. This is where $20 down payment car insurance becomes a practical solution for many drivers. Here are some key benefits of choosing this type of insurance.

Immediate Coverage: One major advantage is the ability to secure immediate coverage. This is particularly useful if you need to get on the road quickly, such as when starting a new job or relocating.

Budget-Friendly Option: The initial cost of car insurance can be a significant barrier. Starting your policy with just $20 makes it easier to manage finances while ensuring road protection.

Flexible Payment Plans: This insurance often allows you to choose a payment plan that fits your financial situation, including monthly installments that spread out the cost over time.

Accessibility for All Drivers: Particularly appealing to new drivers or those with less-than-perfect credit, this insurance provides an accessible entry point into the world of car insurance, ensuring everyone can drive legally and safely. In summary, $20 down payment car insurance offers immediate coverage, budget-friendly plans, and flexible payment options, making it an attractive choice for many drivers. Whether you’re looking for affordability or flexibility, this insurance can meet your needs while keeping you protected on the road.

Comparing $20 Down Payment Car Insurance with Traditional Policies

Navigating car insurance options can be daunting, but the $20 down payment car insurance offers a popular alternative to traditional policies. This option is particularly appealing for those who find the upfront costs of conventional insurance prohibitive. By paying just $20 upfront, drivers can secure coverage, making it an accessible choice for many.

Key Benefits:

- Affordability: Ideal for budget-conscious individuals, this option minimizes initial costs.

- Immediate Coverage: Provides quick insurance without the need for a large upfront payment.

- Flexibility: Often includes adaptable payment plans to better manage finances.

Real-World Example Take Sarah, a young professional who relocated to a new city. With limited savings, she needed car insurance to commute. Choosing a $20 down payment policy allowed her to obtain necessary coverage without financial strain, offering her peace of mind and flexible payment terms.

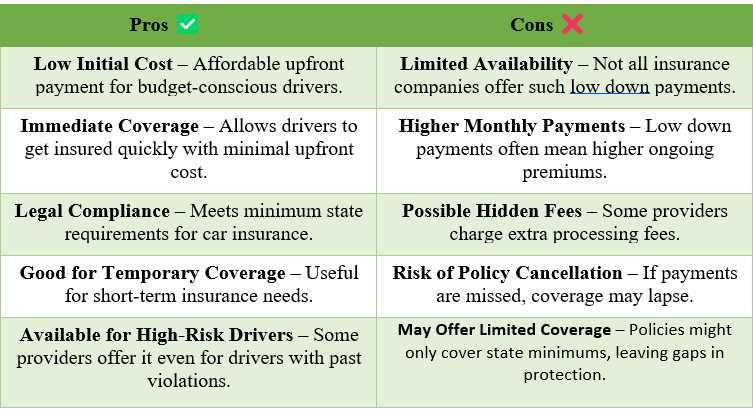

Comparison with Traditional Policies Traditional policies typically require a larger upfront payment but may offer more comprehensive coverage and lower monthly premiums. However, for those needing immediate coverage without a significant initial outlay, the $20 down payment option can be invaluable. Ultimately, the choice between a $20 down payment car insurance and a traditional policy hinges on individual financial circumstances and coverage needs. By evaluating the pros and cons, you can select the option that best aligns with your lifestyle and budget.

Tips for Finding the Best $20 Down Payment Car Insurance Deals

Finding the right car insurance can be challenging, especially when you’re on a budget. Luckily, $20 down payment car insurance provides a more affordable entry point for many drivers. To secure the best deal, start by comparing multiple quotes. Different insurers offer various rates and terms, so shopping around is crucial. Use websites and apps that aggregate quotes to easily compare offers without contacting each provider individually.

- Understand the Coverage: Ensure you know what’s included in your policy. A low down payment might lead to higher monthly premiums or less comprehensive coverage.

- Check for Discounts: Look for discounts offered by insurers for safe driving, bundling policies, or being a student, which can significantly lower your costs.

- Review Customer Feedback: Customer reviews and ratings can provide insights into the company’s service and claims process.

It’s also important to assess your own needs. Consider your driving habits, the value of your car, and your financial situation. For example, infrequent drivers might not need as extensive coverage as daily commuters.

Take the next step toward affordable coverage. Visit NewAutoInsurance and get instant quotes that fit your budget and driving needs. If you’d like to speak with a representative, call us at 833-211-3817!

Lastly, don’t shy away from negotiating with insurers. Sometimes, asking for a better rate or explaining your financial situation can result in more favorable terms. Aim to balance affordability with adequate coverage for peace of mind.

Common Misconceptions About $20 Down Payment Car Insurance

Many drivers are drawn to $20 down payment car insurance due to its low upfront cost, but several misconceptions can cause confusion. Understanding these can help you make better decisions. Firstly, a $20 down payment doesn’t equate to lower overall costs. While the initial payment is small, monthly premiums may be higher to offset this. It’s essential to consider the total cost over the policy term rather than just the initial payment.

Another misconception is that all insurers offer $20 down payment options. This isn’t universally available and often depends on factors like your location, driving history, and the insurer’s policies. It’s wise to shop around and inquire directly with insurers about their down payment options. Here are some key insights:

- Evaluate the total cost: Consider the overall expense of the insurance policy, not just the down payment.

- Check availability: Verify with each provider, as not all offer $20 down payment plans.

- Understand the terms: Read the fine print, especially regarding monthly premiums and coverage limits.

Lastly, some believe $20 down payment insurance is only for those with poor credit. While it can be an option for those with less-than-perfect credit, it’s also available to those with good credit who prefer low initial costs. Understanding these nuances helps in choosing the best insurance plan.

How $20 Down Payment Car Insurance Can Save You Money

Navigating car insurance can be challenging, especially when balancing coverage with affordability. A $20 down payment car insurance offers a practical solution to ease the financial burden of securing necessary coverage. This option allows you to obtain insurance without a hefty upfront cost, which is particularly beneficial for those on a tight budget or facing unexpected expenses. By lowering the initial payment, you can retain more cash while still meeting legal insurance requirements.

Key Benefits of $20 Down Payment Car Insurance:

- Affordability: With just $20 down, you can spread the remaining cost over manageable monthly payments, simplifying budgeting.

- Immediate Coverage: Start driving legally and safely without the need to save up for a larger down payment.

- Flexibility: Many insurers offer customizable plans, allowing you to adjust coverage levels to suit your needs and financial situation.

Take Sarah, for example, a young professional who recently moved to a new city for work. Facing moving expenses, she needed affordable car insurance. Opting for a $20 down payment plan enabled her to get on the road quickly, focusing on settling into her new environment without financial stress. In conclusion, $20 down payment car insurance provides an affordable coverage solution without compromising quality. Understanding its benefits and exploring options can help you make informed decisions that align with your financial goals and lifestyle needs.

Steps to Apply for $20 Down Payment Car Insurance Online

Finding a car insurance policy with a $20 down payment can simplify the process and make it more affordable. Applying online is convenient and allows for easy comparison of options. Here’s a concise guide to help you secure this affordable insurance.

1. Research and Compare Providers Begin by researching insurance companies that offer $20 down payment options. Use comparison websites to evaluate multiple providers, focusing on those with positive customer reviews and a strong reputation.

2. Gather Necessary Information Before starting your application, collect essential information such as your driver’s license number, vehicle details (make, model, year), current insurance information, and personal details like your address and contact information.

3. Fill Out the Online Application After selecting a provider, visit their website to find the online application form. Accurately fill in all required details. These forms are generally user-friendly, guiding you through each step to ensure completeness.

4. Customize Your Coverage Insurers often allow policy customization. Choose coverage levels and additional options like roadside assistance or rental car coverage to maximize the value of your $20 down payment.

5. Review and Submit Review your application thoroughly to ensure accuracy and avoid processing delays. Once everything is correct, submit your application and wait for confirmation from the insurer. Applying for $20 down payment car insurance online is a simple process that can save both time and money, providing peace of mind on the road.

FAQ

-

Can I get car insurance with a $20 down payment?

Some insurers offer low down payment options, but availability depends on location and driving record. -

Which companies offer $20 down payment car insurance?

Dairyland, The General, and Direct Auto sometimes provide low down payment plans. -

Is $20 down payment insurance a scam?

No, but read the fine print—monthly payments may be higher later. -

How can I qualify for low down payment auto insurance?

Good credit, a clean driving record, and bundling policies can help lower upfront costs. -

Does low down payment insurance cover the same as regular policies?

Yes, but full coverage and liability options depend on the insurer.

Take the next step toward affordable coverage. Visit NewAutoInsurance and get instant quotes that fit your budget and driving needs. If you’d like to speak with a representative, call us at 833-211-3817!

Explore InsuranceShopping to find a wide range of insurance options tailored to your needs.