Understanding Cheap Auto Insurance in CT: What You Need to Know

Finding affordable auto insurance in Connecticut can seem challenging, but it’s entirely achievable with the right approach. Cheap auto insurance in CT doesn’t mean compromising on quality. Many insurers offer competitive rates with comprehensive coverage. Opting for cheaper insurance can lead to significant cost savings, providing more financial flexibility each month. Additionally, the flexibility of customizable plans allows you to pay only for what you need, and the abundance of providers in CT gives you the freedom to shop around and compare rates.

To secure affordable coverage, start by comparing quotes using online tools to get a clear picture of available options. Look for potential discounts, such as those for safe driving or bundling policies, which can further reduce costs. It’s also crucial to evaluate your coverage needs based on your driving habits to avoid unnecessary expenses. By understanding these strategies, you can make informed decisions and find a policy that balances cost and coverage, ensuring peace of mind. The key is to align your insurance needs with your budget, ensuring you get the best value without sacrificing essential coverage.

Top Tips for Finding Affordable Auto Insurance in Connecticut

Securing cheap auto insurance in CT doesn’t have to be overwhelming. By following a few strategic steps, you can find a policy that suits your budget without sacrificing coverage. Start by comparing quotes from various insurers, as each company calculates rates differently. Online comparison tools are invaluable for quickly assessing a range of options. Bundling your policies is another effective strategy. If you have existing homeowners or renters insurance, inquire about discounts for combining these with your auto policy. This can lead to substantial savings on your overall insurance costs.

Here are some additional tips to consider:

- Maintain a good credit score: A higher score often results in lower premiums.

- Opt for a higher deductible: This reduces your monthly premium, though you’ll pay more out-of-pocket for claims.

- Leverage available discounts: Look for savings on safe driving, low mileage, or academic achievements.

Regularly reviewing your policy is essential, especially after life changes like moving or purchasing a new vehicle. Staying informed and proactive ensures you consistently get the best deal on your auto insurance in Connecticut.

How to Compare Cheap Auto Insurance Quotes in CT Effectively

Finding affordable auto insurance in CT can be challenging, but with the right strategy, it becomes easier. The secret lies in comparing quotes effectively to secure the best deal without sacrificing coverage. Begin by collecting quotes from various insurers, as each evaluates risk differently, leading to significant price variations for similar coverage. Online comparison tools can simplify this process.

Key steps for a thorough comparison include:

- Evaluate Coverage Options: Ensure the policy meets all your needs, from liability to comprehensive coverage, rather than focusing solely on price.

- Check for Discounts: Look for potential savings through discounts for safe driving, policy bundling, or having safety features in your vehicle.

- Review Customer Feedback: Assess reviews and ratings to understand customer satisfaction and service quality.

After narrowing down your options, scrutinize the fine print. Pay attention to deductibles, limits, and exclusions that might impact your coverage. Some policies may offer lower premiums but have higher deductibles, potentially increasing costs during claims. Finally, consult insurance agents for clarity on any confusing terms. They can offer valuable insights into each policy’s nuances, ensuring you make an informed choice. By following these steps, you can find cheap auto insurance in CT that fits your needs and budget.

Take the next step toward affordable coverage. Visit NewAutoInsurance and get instant quotes that fit your budget and driving needs. If you’d like to speak with a representative, call us at 833-211-3817!

The Best Cheap Auto Insurance Providers in Connecticut

Finding affordable auto insurance in Connecticut is easier than you might think. By researching and understanding what different providers offer, you can secure a budget-friendly policy without sacrificing coverage.

Here are some top options for cheap auto insurance in CT:

1. Geico offers competitive rates and excellent customer service, making it a reliable choice for many Connecticut drivers. With discounts for good drivers, military personnel, and multi-policy holders, Geico helps you save on premiums.

2. State Farm is favored for its personalized service and extensive agent network. It provides discounts for safe driving and bundling home and auto insurance, which can significantly lower your insurance costs.

3. Progressive features the Name Your Price tool, allowing policy customization based on your budget. It also offers discounts for continuous coverage and automatic payments, making it a flexible option for cheap auto insurance in CT.

Tips for Securing Affordable Auto Insurance:

- Compare Quotes: Ensure you’re getting the best deal by comparing multiple providers.

- Consider Usage-Based Insurance: Programs like Progressive’s Snapshot offer discounts based on driving habits.

- Increase Your Deductible: A higher deductible can lower your premium, but ensure it’s affordable in case of a claim.

By exploring these options and discounts, you can find affordable auto insurance in Connecticut that meets your needs and budget.

Factors Influencing Cheap Auto Insurance Rates in CT

Finding cheap auto insurance in CT requires understanding several key factors that influence rates. Connecticut’s mix of urban and rural areas presents unique considerations for insurers.

Driving record is a primary factor; a clean record often results in lower premiums, as it suggests a lower risk of future claims. For example, a Hartford resident with no violations may enjoy more affordable rates than someone with multiple tickets. The type of vehicle also impacts insurance costs. Vehicles with high safety ratings and lower repair expenses generally attract cheaper rates. Owning a compact sedan with excellent crash test results could significantly reduce your premium compared to a luxury sports car.

Coverage options are another consideration. Opting for higher deductibles can lower monthly payments, though it increases out-of-pocket costs during claims. Balancing coverage needs with budget constraints is crucial for finding the best deal.

- Location: Urban areas like Bridgeport or New Haven may have higher rates due to increased traffic risks.

- Credit Score: A higher credit score often leads to better rates.

- Annual Mileage: Driving less can result in cheaper insurance.

In summary, securing affordable auto insurance in CT involves strategic choices and personal habits, helping you save significantly on premiums.

How to Lower Your Auto Insurance Premiums in Connecticut

Finding affordable auto insurance in Connecticut can be challenging, but with strategic planning, you can secure cheap auto insurance in CT without sacrificing coverage. Start by shopping around and comparing quotes from different insurers, as rates can vary significantly.

Key tips include:

- Evaluate Coverage Needs: Identify essential coverage and consider a higher deductible to lower premiums.

- Look for Discounts: Insurers often provide discounts for safe driving, policy bundling, or customer loyalty.

- Check Your Credit Score: A good credit score can lead to lower rates since insurers view you as a lower risk.

Real-world examples highlight the savings potential. For instance, Sarah from Hartford reduced her premium by 20% by bundling her home and auto insurance. Maintaining a clean driving record is also crucial, as it not only ensures safety but can also lower premiums.

Additional strategies include:

- Take a Defensive Driving Course: This can sometimes earn you a discount.

- Limit Mileage: Driving less may qualify you for a low-mileage discount.

- Install Safety Features: Anti-theft devices can lower your risk profile.

By following these steps, you can enjoy affordable auto insurance in Connecticut while staying well-covered.

Common Mistakes to Avoid When Buying Cheap Auto Insurance in CT

Finding affordable auto insurance in Connecticut can be challenging, but it’s important to avoid common pitfalls that could lead to inadequate coverage. One major mistake is focusing solely on price. While a low-cost policy might seem appealing, it may not provide sufficient protection in the event of an accident. Balancing cost with coverage is essential to ensure you’re adequately protected. Another frequent error is not comparing multiple quotes. Many drivers accept the first offer they receive, potentially missing out on better deals. By shopping around and using online comparison tools, you can find a policy that offers both affordability and comprehensive coverage.

- Skipping the fine print: Always read the terms and conditions to avoid hidden fees or exclusions.

- Ignoring discounts: Insurers often provide discounts for safe driving, bundling policies, or being a good student. Be sure to inquire about these options.

Maintaining a good driving record is also crucial, as insurers typically offer lower rates to drivers with clean records. By avoiding traffic violations and accidents, you can keep premiums low while benefiting from cheap auto insurance in CT. Avoiding these mistakes will help you secure an affordable policy without sacrificing coverage.

The Benefits of Choosing Cheap Auto Insurance in Connecticut

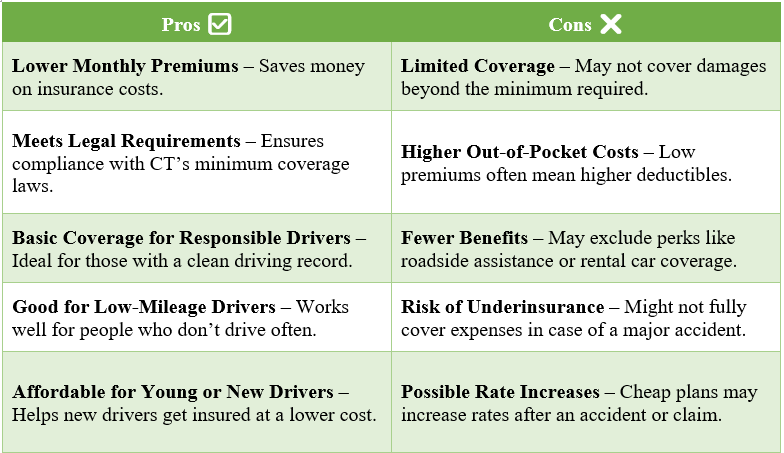

Affordable auto insurance in Connecticut not only saves money but also ensures peace of mind and financial security. Many drivers are realizing that cheap auto insurance in CT can provide comprehensive coverage without a hefty price tag. Here’s why these policies are advantageous:

Cost Savings: Opting for cheap auto insurance can significantly lower your monthly expenses, which is particularly beneficial for young drivers or those on a tight budget.

- Lower Premiums: These policies often come with reduced premiums, freeing up funds for other necessities.

- Flexible Payment Options: Insurers frequently offer flexible payment plans, aiding in better financial management.

Comprehensive Coverage: Despite being budget-friendly, cheap auto insurance in CT can still offer extensive coverage options, ensuring you don’t compromise on protection.

- Liability Coverage: This protects you in accidents where you’re at fault, covering damages and legal costs.

- Collision and Comprehensive: Many affordable plans include collision and comprehensive coverage, protecting your vehicle from various risks.

For instance, Sarah, a college student in Hartford, found a policy that fit her budget and provided excellent coverage for her used car, allowing her to focus on her studies without financial stress. In summary, cheap auto insurance in Connecticut is a practical choice for balancing cost and coverage, letting you drive with confidence.

How Your Driving Record Affects Cheap Auto Insurance in CT

Your driving record is a key factor in determining your auto insurance rates in Connecticut. Insurers use your history as a predictor of future behavior, with a clean record often leading to lower premiums. Conversely, a history of accidents or violations can result in higher costs. Here’s how it works:

Key Factors Influencing Your Insurance Rates:

- Accidents: Being involved in accidents, particularly those where you’re at fault, can label you as a higher risk, increasing your premiums.

- Traffic Violations: Infractions like speeding tickets and DUIs add points to your record, impacting your rates significantly.

- Claims History: Frequent claims, even minor ones, suggest higher risk to insurers.

Consider two drivers in Connecticut: Driver A with a spotless record and Driver B with speeding tickets. Driver A finds cheaper insurance options, illustrating the importance of a clean record for affordable coverage.

Tips for Maintaining a Clean Driving Record:

- Drive Defensively: Stay aware and anticipate other drivers’ actions.

- Obey Traffic Laws: Adhering to speed limits and signs prevents violations.

- Regular Vehicle Maintenance: Ensures your car is safe and reduces accident risk.

Understanding your driving record’s impact on insurance rates helps you take steps to secure cheap auto insurance in CT. A cautious approach today can lead to savings tomorrow.

Exploring Discounts for Cheap Auto Insurance in Connecticut

Finding cheap auto insurance in CT can be easier than you think if you know where to look for discounts. Many drivers overlook the variety of discounts available, which can significantly reduce their premiums. Here are some key discounts to consider:

Multi-Policy Discounts: Bundling your auto insurance with other policies like home or renters insurance can lead to substantial savings. This approach not only simplifies your insurance management but also cuts costs.

Safe Driver Discounts: Maintaining a clean driving record pays off. Insurers often offer lower rates to drivers without accidents or traffic violations, rewarding safe driving habits.

Good Student Discounts: Young drivers can benefit from good grades. Insurance companies frequently provide discounts to students who maintain a certain GPA, acknowledging their responsibility.

Vehicle Safety Features: Cars with advanced safety features such as anti-lock brakes and airbags may qualify for discounts. These features lower the risk of accidents and theft, making you a safer bet for insurers. By leveraging these discounts, you can secure affordable auto insurance in Connecticut without compromising on coverage. Always consult with your insurance agent to ensure you’re getting the best deal possible.

Take the next step toward affordable coverage. Visit NewAutoInsurance and get instant quotes that fit your budget and driving needs. If you’d like to speak with a representative, call us at 833-211-3817!

Explore InsuranceShopping to find a wide range of insurance options tailored to your needs.