Top Affordable Cars That Won’t Break the Bank

Finding a budget-friendly car can seem daunting, but there are numerous options that offer excellent value without sacrificing quality. Whether you’re a first-time buyer or looking to downsize, choosing an affordable car is a wise financial move. These vehicles not only come with a lower price tag but also often align with cheap insurance options, providing a dual benefit for your finances. Cheap Cars and Cheap Insurance Why Consider Affordable Cars?

- Cost-Effective: These cars generally have lower purchase prices, resulting in smaller monthly payments or less impact on your savings.

- Fuel Efficiency: Many budget-friendly cars are designed to be fuel-efficient, helping you save money on fuel.

- Lower Insurance Rates: Affordable cars often come with reduced insurance premiums, especially if they boast good safety ratings.

Real-World Examples The Honda Civic is a popular choice among budget-conscious buyers due to its reliability and fuel efficiency, making it an excellent example of affordability and quality. Similarly, the Toyota Corolla is renowned for its longevity and low maintenance costs. Both models are not only economical in terms of purchase price but also tend to have lower insurance rates, making them ideal for those looking to save. In summary, choosing a cheap car doesn’t mean compromising on quality or style. With some research, you can find a vehicle that suits your needs and keeps your finances in check. Plus, with the added advantage of cheap insurance, you can enjoy peace of mind while driving without breaking the bank.

How to Find Cheap Car Insurance Without Compromising Coverage

Securing affordable car insurance without sacrificing coverage can be challenging, especially when you’re also searching for a budget-friendly vehicle. However, with strategic planning and informed decisions, you can find a policy that offers protection without straining your finances. Here’s how: Begin by obtaining quotes from various insurance providers. Although it may seem straightforward, many individuals settle for the first quote they receive. By comparing rates, you can discover competitive options that align with your budget. Utilize online tools to streamline this process.

- Bundle Policies: If you have existing home or renters insurance, inquire about discounts for bundling multiple policies. This approach can lead to significant savings on premiums.

- Opt for a Higher Deductible: Choosing a higher deductible can reduce your monthly payments. Ensure you have sufficient funds to cover the deductible if an accident occurs.

- Seek Discounts: Insurers often provide discounts for safe driving, low mileage, or academic excellence. Explore all available discounts to enhance your savings.

When selecting a cheap car, prioritize models known for reliability and low maintenance costs. Vehicles with high safety ratings typically qualify for lower insurance rates, as they are less likely to incur expensive claims. Brands like Honda and Toyota are renowned for their affordability and durability, making them ideal for cost-conscious buyers. Ultimately, finding cheap car insurance without compromising coverage requires being informed and proactive. By understanding your needs and exploring all options, you can enjoy peace of mind, knowing you’re well-protected without overspending.

The Best Budget-Friendly Cars for First-Time Buyers

Buying your first car is a thrilling milestone, yet it can be challenging, especially on a budget. Thankfully, numerous affordable options offer quality and safety without breaking the bank. These budget-friendly cars also come with the advantage of cheap insurance, making them perfect for first-time buyers. Why Choose a Budget-Friendly Car? Affordable cars don’t mean sacrificing reliability or style. They often provide excellent fuel efficiency, low maintenance costs, and modern features that enhance driving pleasure. Key benefits include:

- Lower Purchase Price: Easier on your wallet, allowing funds for insurance and maintenance.

- Economical Fuel Consumption: Designed for fuel efficiency, saving money at the pump.

- Affordable Insurance Rates: Lower premiums for cars with good safety ratings and lower market values.

Top Picks for First-Time Buyers

- Honda Civic: Renowned for reliability and resale value, its compact design and fuel efficiency make it practical.

- Toyota Corolla: Known for durability and low maintenance, it offers safety features and a comfortable interior.

- Ford Fiesta: Affordable and fun, with a sporty design and advanced tech features.

Tips for Finding Cheap Insurance

- Compare Quotes: Shop around for the best insurance deals.

- Consider Usage-Based Insurance: Discounts for low-mileage drivers or those using telematics.

- Look for Discounts: Available for students, safe drivers, or policy bundlers.

Choosing a budget-friendly car and leveraging cheap insurance options allows first-time buyers to enjoy driving freedom without financial strain. Balancing affordability with quality ensures your first car is a wise and enjoyable investment.

Tips for Lowering Your Car Insurance Premiums

Navigating the world of car insurance can be challenging, especially when you’re also looking for a budget-friendly vehicle. Fortunately, there are effective strategies to help you lower your insurance premiums without sacrificing coverage. Here’s how you can make the most of your insurance search. 1. Shop Around for the Best Rates It’s crucial not to accept the first quote you receive. Insurance rates vary significantly between providers, so comparing quotes from multiple companies is essential. Websites like Insure.com or The Zebra can streamline this process, helping you find competitive rates quickly. 2. Opt for a Higher Deductible Increasing your deductible can reduce your monthly premium. While this means higher out-of-pocket costs if you file a claim, it can be beneficial if you have a good driving record and rarely need to make claims. 3. Take Advantage of Discounts Insurance companies often provide discounts that can lower your premiums. Consider these options:

- Good Driver Discounts: Available for those with a clean driving record.

- Multi-Policy Discounts: Savings for bundling car insurance with other policies.

- Low Mileage Discounts: Offered to drivers who don’t log many miles annually.

4. Choose a Car Wisely Selecting a car with high safety ratings and low theft rates can lead to lower insurance costs. Models like the Honda Civic or Toyota Corolla are not only affordable but also insurance-friendly. By implementing these tips, you can secure affordable car insurance, freeing up your budget for other priorities. Stay informed and proactive to ensure you get the best rates possible.

Take the next step toward affordable coverage. Visit NewAutoInsurance and get instant quotes that fit your budget and driving needs. If you’d like to speak with a representative, call us at 833-211-3817!

Affordable Cars with the Best Fuel Efficiency

Finding a car that balances affordability and fuel efficiency can be challenging, but with the right approach, you can secure a vehicle that saves money both at purchase and in fuel costs. Toyota Corolla and Honda Civic are prime examples of such cars, offering budget-friendly prices and excellent fuel economy. The Corolla achieves 30 miles per gallon in the city and 38 on the highway, while the Civic offers similar efficiency. Both models are renowned for their reliability, reducing the need for frequent repairs and thus saving you more money. These vehicles also benefit from cheap insurance rates. Insurers prefer cars that are cost-effective to repair and have strong safety records, which both the Corolla and Civic possess. Opting for a fuel-efficient, affordable car brings several advantages:

- Lower Fuel Costs: Spend less on gas, freeing up funds for other priorities.

- Reduced Insurance Premiums: Benefit from lower insurance rates due to the car’s safety and reliability.

- Environmental Impact: Drive a vehicle that contributes to lower emissions and a greener planet.

Choosing a car that merges affordability with fuel efficiency not only saves you money initially but also offers long-term financial benefits. Whether you’re a student, a young professional, or simply looking to reduce expenses, these cars provide a smart and sustainable option.

Understanding the Factors That Affect Cheap Car Insurance Rates

Securing affordable car insurance involves understanding the factors that influence your premiums. Whether you’re driving a budget-friendly sedan or a compact hatchback, knowing what insurers consider can lead to significant savings. Here are the key elements affecting your insurance rates and how you can use them to your advantage.

Vehicle Type and Model: Choosing a car with a lower market value often results in cheaper insurance rates. Insurers assess the cost of repairs and replacement, so a less expensive vehicle typically means lower premiums. Additionally, cars with advanced safety features like anti-lock brakes, airbags, and electronic stability control are generally cheaper to insure due to their reduced accident risk.

Driving Record: A clean driving record is crucial for securing cheap insurance. Insurers offer lower rates to drivers with no history of accidents or traffic violations. If your record isn’t spotless, consider taking a defensive driving course to potentially reduce your premiums.

Location Matters: Your place of residence significantly impacts your insurance rates. Urban areas with higher traffic and crime rates usually have higher premiums compared to rural locations. If you’re planning a move, it might be beneficial to check how your new zip code could affect your insurance costs. By understanding these factors, you can make informed decisions when shopping for both cheap cars and insurance. While price is important, ensuring adequate coverage is essential for protecting your investment and peace of mind.

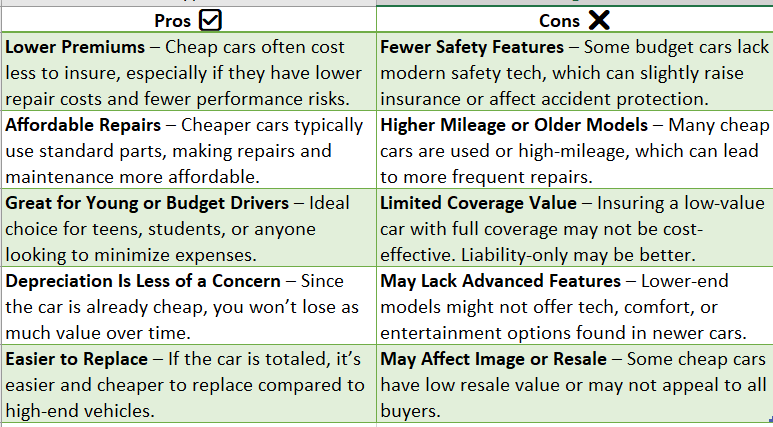

The Pros and Cons of Buying Used Cars for Insurance Savings

Opting for a used car can be a strategic choice for those aiming to cut down on both the purchase price and ongoing costs like insurance. The appeal of cheap cars is clear, but it’s important to consider both the advantages and potential downsides. Pros of Buying Used Cars:

- Lower Purchase Price: Used cars are typically more budget-friendly than new ones, offering better value.

- Reduced Depreciation: Unlike new cars that depreciate rapidly, used cars have already experienced the steepest drop in value, retaining their worth more effectively.

- Cheaper Insurance Rates: Insurance premiums for used cars tend to be lower since their replacement or repair costs are less than those of new vehicles.

Despite these benefits, there are challenges to be aware of when buying a used car. Cons of Buying Used Cars:

- Higher Maintenance Costs: Older vehicles might need more frequent repairs, which can accumulate over time.

- Limited Warranty Coverage: Used cars often lack the comprehensive warranty protection that new cars offer, potentially leading to additional repair expenses.

- Outdated Safety Features: Older models may not have the latest safety technologies, which could affect insurance rates and safety.

To maximize savings and minimize risks, thorough research is essential when considering a used car. Seek out models known for reliability and low maintenance costs. A vehicle history report can also provide valuable insights into any past issues or accidents, helping you make a more informed decision. By carefully evaluating these factors, you can enjoy the financial benefits of cheap cars and insurance without sacrificing quality or safety.

How to Compare Cheap Car Insurance Quotes Effectively

Navigating the world of affordable car insurance, especially when paired with the search for a cheap car, can seem daunting. However, with strategic planning, you can secure a deal that fits your budget and needs. Here’s how to effectively compare cheap car insurance quotes. First, recognize that insurance policies differ significantly. While cost is crucial, coverage details matter too. Begin by assessing your needs:

- Coverage Requirements: Know your state’s minimum coverage and consider additional protection based on your car’s value and personal needs.

- Budget Constraints: Establish a realistic premium budget, remembering that the cheapest option might not offer adequate coverage.

Next, gather quotes using online comparison tools. These platforms simplify the process by allowing you to enter your details once and receive multiple quotes, saving time and effort. When evaluating quotes, focus on more than just the price. Consider these factors:

- Deductibles: Opting for higher deductibles can reduce premiums but increases out-of-pocket expenses during claims.

- Discounts: Look for discounts related to safe driving, policy bundling, or car safety features.

- Customer Reviews: Online reviews can provide insights into an insurer’s customer service and claims process.

Lastly, consult insurance agents for tailored advice. They can help identify policies offering the best value for your situation. By following these steps, you can find both a cheap car and affordable insurance without sacrificing quality.

FAQ

-

What are the cheapest cars to insure?

Cars like the Honda CR-V, Subaru Outback, and Toyota Corolla often have lower insurance rates due to safety features and repair costs. -

Does a cheaper car mean cheaper insurance?

Not always—insurance also depends on factors like repair costs, safety ratings, and theft risk. -

How can I lower my insurance on a cheap car?

Choose a car with good safety ratings, increase your deductible, bundle policies, and maintain a clean driving record. -

Are older cars cheaper to insure?

Often yes, because they have lower market value—but it depends on the make, model, and coverage needs. -

Is liability-only insurance a good option for cheap cars?

Yes, especially if the car’s value is low and full coverage isn’t cost-effective.

Take the next step toward affordable coverage. Visit NewAutoInsurance and get instant quotes that fit your budget and driving needs. If you’d like to speak with a representative, call us at 833-211-3817!

Explore InsuranceShopping to find a wide range of insurance options tailored to your needs.