Understanding Electric Car Insurance: What Makes It Different?

Electric car insurance is becoming more important as these vehicles zoom into our lives. With more people choosing electric cars for their eco-friendliness and cost savings, understanding how insurance works for these vehicles is crucial. But what makes electric car insurance different from regular car insurance? Let’s dive in and find out!

Why Electric Cars Need Special Insurance

Electric cars have unique features that set them apart from traditional vehicles. For instance, they have expensive batteries and advanced technology. This means that if something goes wrong, repairs can be pricier. Insurance for electric cars often covers these specific needs, ensuring you’re protected without breaking the bank.

Key Differences in Coverage

- Battery Coverage: Since the battery is one of the most expensive parts, having insurance that covers battery damage or replacement is vital.

- Charging Equipment: Some policies include protection for home charging stations, which can be costly to repair or replace.

- Roadside Assistance: Electric cars may need special towing services, so having insurance that includes this can be a lifesaver.

Benefits of Electric Car Insurance

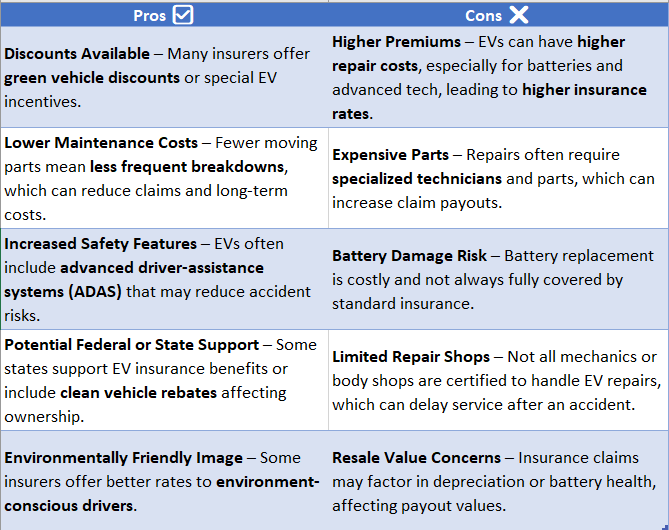

Electric car insurance not only protects your vehicle but also offers peace of mind. With the right coverage, you can enjoy your eco-friendly ride without worrying about unexpected costs. Plus, some insurers offer discounts for electric cars, making it even more affordable to go green.

Why Electric Car Insurance Costs More: Breaking Down the Factors

Electric car insurance is crucial as more people opt for eco-friendly vehicles. But why does it often cost more than regular car insurance? Knowing the reasons can help you choose the right coverage for your electric vehicle.

Higher Repair Costs

Electric cars are full of advanced technology, making repairs more expensive. Fixing a battery or specialized part might require a specialized mechanic, leading to higher bills.

Limited Repair Shops

Not all mechanics can fix electric cars, meaning fewer repair options. This scarcity can increase costs, as specialized skills often come with a higher price tag.

Expensive Parts

Parts like batteries and electric motors are pricier than those for traditional cars. Their high cost contributes to the overall insurance expense.

Higher Initial Cost

Electric cars generally have a higher purchase price than gas-powered cars. Insurance companies factor this in when setting rates, as a more expensive car can lead to higher claims if damaged or stolen.

Understanding these factors clarifies why electric car insurance might be more expensive. However, the benefits of driving an electric car, such as lower fuel costs and reduced emissions, often outweigh these costs. So, while the insurance might be a bit more, the overall advantages make it worthwhile.

How to Choose the Best Electric Car Insurance for Your Needs

Electric cars are becoming increasingly popular, and with them comes the necessity for specialized insurance. Electric car insurance is essential because it addresses the unique features of electric vehicles, such as battery protection and charging equipment. Selecting the right policy ensures you’re safeguarded against unforeseen expenses, allowing you to enjoy your eco-friendly vehicle without worry.

When choosing electric car insurance, it’s vital to consider several factors to find the best match for your lifestyle and budget. Here are some key points to consider:

Understand Your Coverage Needs

- Battery Protection: The battery is a significant part of an electric car’s value, so make sure your policy covers battery damage or theft.

- Charging Equipment: Ensure your coverage includes home charging stations and public charging incidents.

- Roadside Assistance: Electric cars may require specialized towing services, so verify if your policy includes this.

Compare Different Providers

Insurance companies offer varying benefits for electric cars. Comparing quotes from different providers helps you find the best coverage. Look for insurers experienced with electric vehicles, as they often provide more tailored services.

Consider Discounts and Incentives

Many insurers provide discounts for electric car owners. You might save through eco-friendly incentives or by bundling your electric car insurance with other policies. Always inquire about available discounts to lower your premium costs.

By understanding these aspects, you can confidently select an electric car insurance policy that meets your needs, ensuring peace of mind as you drive into a greener future.

The Future of Electric Car Insurance: Trends and Innovations

Electric cars are becoming more popular every day, and with this rise, the need for electric car insurance is growing too. As more people switch to these eco-friendly vehicles, understanding how to protect them becomes crucial. Electric car insurance is not just about covering accidents; it’s about embracing the future of transportation.

Electric car insurance is evolving rapidly. Traditional policies are being adapted to meet the unique needs of electric vehicles. This includes coverage for battery damage, charging station mishaps, and even software updates. As technology advances, insurance companies are finding new ways to offer protection that fits the electric lifestyle.

Key Innovations in Electric Car Insurance:

- Battery Coverage: Since batteries are expensive, having insurance that covers battery damage or replacement is essential.

- Charging Station Protection: Policies now often include coverage for damage or theft at charging stations.

- Software and Tech Support: With electric cars relying heavily on software, insurance can cover issues related to software malfunctions.

As electric cars become smarter, so does the insurance that protects them. Companies are using data from smart sensors to offer personalized policies. This means safer drivers might pay less, while those who drive more aggressively could see higher premiums. It’s a win-win for safety and savings. In conclusion, electric car insurance is not just a necessity; it’s an exciting part of the electric vehicle revolution. By understanding the trends and innovations, drivers can make informed choices that protect their investment and embrace the future of driving.

Searching for affordable auto insurance? Head over to NewAutoInsurance to compare quotes and save on your policy! Have questions? Call us at 833-211-3817 for immediate assistance!

Electric Car Insurance Discounts: How to Save on Your Premiums

Electric cars are zooming into our lives, bringing not just eco-friendly benefits but also unique insurance needs. Electric car insurance is crucial because it covers the specific risks associated with these vehicles, like battery damage or charging station mishaps. But did you know you can save money on your premiums? Let’s explore how!

Understanding Electric Car Insurance Discounts

Electric car insurance can be more affordable than you think. Many insurance companies offer discounts for electric vehicles because they are often safer and less prone to accidents. Plus, they are environmentally friendly, which insurers love!

How to Qualify for Discounts

To snag these discounts, start by shopping around. Different insurers offer different rates, so compare them. Also, consider bundling your policies, like home and auto insurance, to get a better deal. Lastly, maintaining a clean driving record can also help you qualify for lower rates.

- Shop Around: Compare rates from various insurers.

- Bundle Policies: Combine home and auto insurance for savings.

- Maintain a Clean Record: Safe driving can lead to discounts.

Additional Tips to Save

Besides discounts, there are other ways to save on electric car insurance. Opt for a higher deductible if you can afford it, as this often lowers your premium. Also, take advantage of any available safety features in your car, like anti-theft devices, which can lead to further savings.

Common Myths About Electric Car Insurance: What You Need to Know

Electric car insurance is becoming increasingly important as more people switch to eco-friendly vehicles. But, there are many myths surrounding it that can confuse potential buyers. Understanding these myths is crucial to making informed decisions about your electric car insurance.

Myth 1: Electric Car Insurance is Always More Expensive

Many people believe that insuring an electric car is always pricier than a gas-powered vehicle. While it’s true that some electric cars can be costly to insure due to their high-tech features, many insurance companies offer discounts for eco-friendly vehicles, making them more affordable.

Myth 2: Electric Cars are Less Safe

Some think electric cars are less safe, which might affect insurance rates. However, electric cars often come with advanced safety features like automatic braking and lane-keeping assistance, which can actually lower insurance costs.

Myth 3: Limited Coverage Options

Another common myth is that there are fewer insurance options for electric cars. In reality, most major insurance providers offer a variety of coverage plans tailored specifically for electric vehicles, ensuring you can find a plan that fits your needs. Understanding these myths helps you make smarter choices about your electric car insurance. By knowing the facts, you can find the best coverage that suits your eco-friendly lifestyle without breaking the bank.

How NewAutoInsurance Simplifies Your Electric Car Insurance Search

Electric cars are the future, and with more people switching to these eco-friendly vehicles, understanding electric car insurance is crucial. Unlike traditional cars, electric vehicles (EVs) have unique needs and considerations. That’s why finding the right insurance can feel overwhelming. But don’t worry! NewAutoInsurance is here to make your search for electric car insurance a breeze.

Why Electric Car Insurance Matters

Electric cars are packed with advanced technology, making them different from gas-powered vehicles. This means they often require specialized insurance coverage. Having the right policy ensures your investment is protected, covering everything from battery replacement to charging station mishaps. Easy Comparison Tools

- User-Friendly Interface: Our platform offers a simple, intuitive interface that lets you compare different electric car insurance options effortlessly.

- Tailored Results: By entering a few details about your EV, you receive personalized insurance quotes that match your specific needs. Expert Guidance

At NewAutoInsurance, we provide expert advice to help you understand the nuances of electric car insurance. Our team is always ready to answer your questions, ensuring you make informed decisions without any hassle.

Save Time and Money

With our streamlined process, you can quickly find the best deals on electric car insurance. This means more time enjoying your electric vehicle and less time worrying about insurance. Plus, our competitive rates help you save money while keeping your car protected.

FAQ

-

Is electric car insurance more expensive?

Yes, it can be slightly higher due to costlier repairs and parts. -

Do insurers offer discounts for electric cars?

Many do, especially for eco-friendly or low-emission vehicles. -

What coverage is recommended for electric cars?

Comprehensive and collision coverage, plus battery protection, is ideal. -

Are charging stations covered in insurance?

Some policies cover home charging units—check with your provider. -

Can I insure an electric car online?

Yes, most insurers allow easy online quotes and purchases.

Explore InsuranceShopping to find a wide range of insurance options tailored to your needs.Take the next step toward affordable coverage. Visit NewAutoInsurance and get instant quotes that fit your budget and driving needs. If you’d like to speak with a representative, call us at 833-211-3817!